M

Mansfieldman750

Lifetime VIP Member

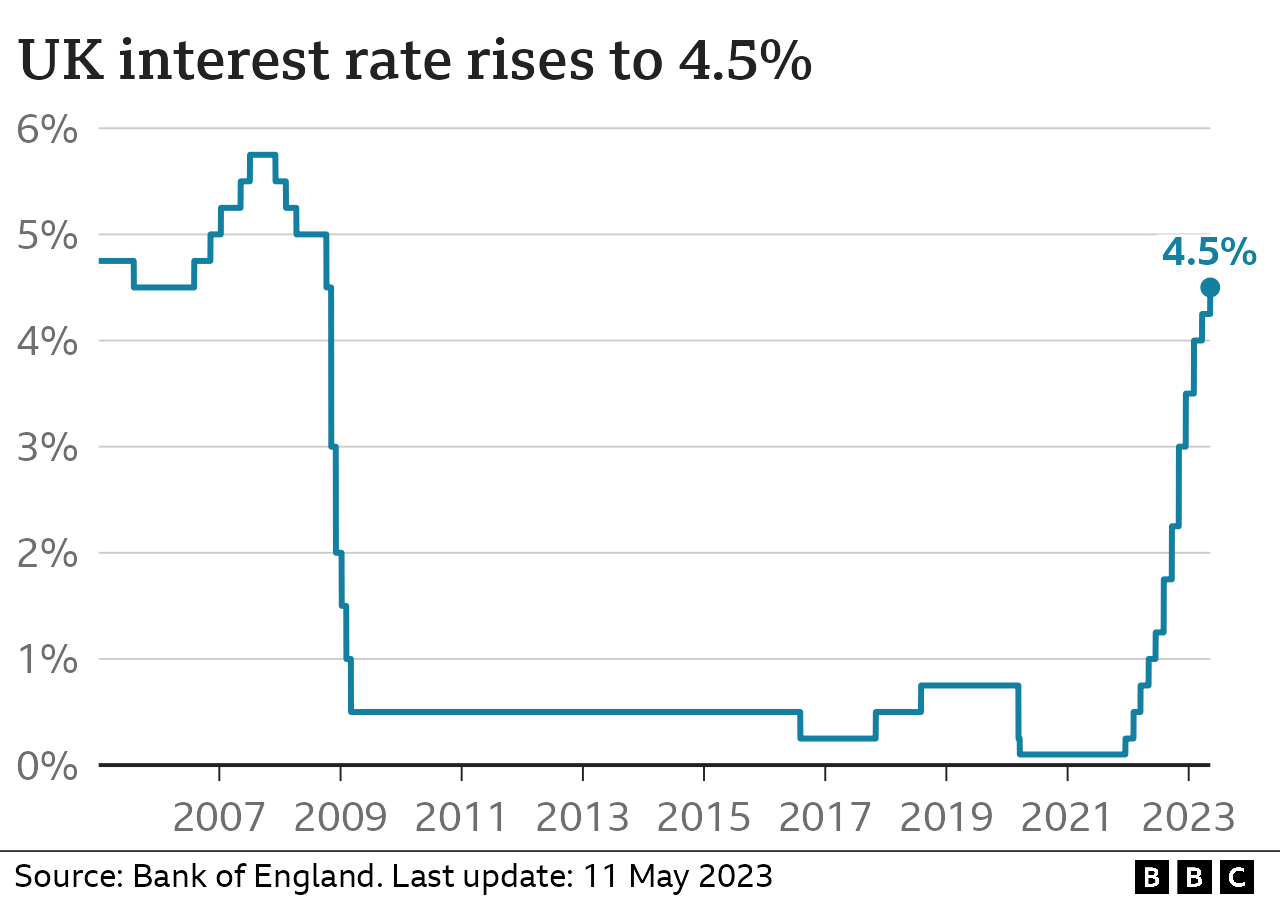

Base rate up 0.25% again. Last increase ? One more ?

Last April’s energy price increase drops out now so the next inflation figure announced on May 23 will look a lot better.

If I had to bet on it I’d say we’re done with increases now.

Last April’s energy price increase drops out now so the next inflation figure announced on May 23 will look a lot better.

If I had to bet on it I’d say we’re done with increases now.